|

|

Payments |

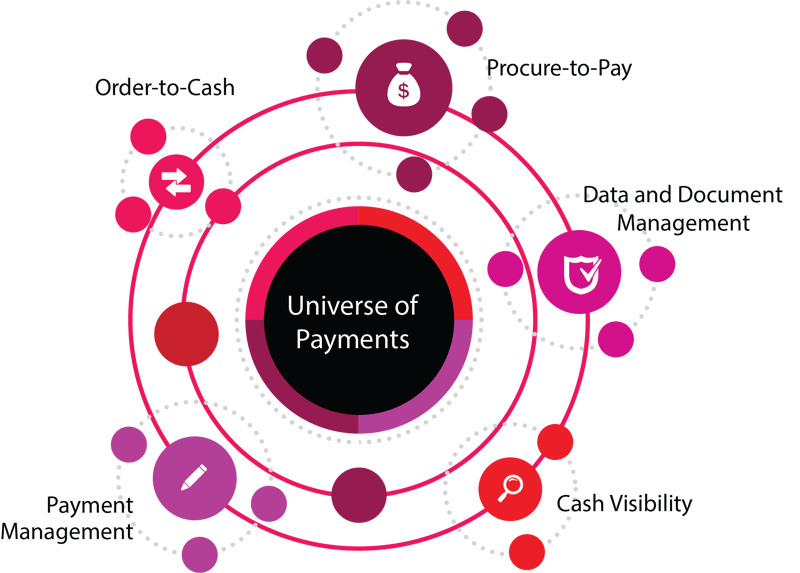

We optimise the universe of payments for organisations that seek efficient cash visibility and secure financial processes. Our solutions and services align to a unique solution approach that enables our clients to minimise financial risk and improve transparency to meet latest audit and compliance requirements.

We help you achieve an end-to-end secure inbound and outbound payments ecosystem and efficient data and document management with future-proof solutions for all financial business processes. The solutions are modular and can be deployed individually or in an integrated approach empowering you to achieve maximum efficiency and achieve your goals.

...the benefits of AP automation are clear—dramatically faster invoice processing times, better cost reductions, and reduced reliance on manual entry tasks to free up workers to more value added roles.

AIIM eBook 2018 The Winding Road to World-Class AP Automation

ECM360 provides processes – from automated supplier evaluation and management, to invoice processing and payment management enabling tight end-to-end security and fraud prevention.

Centralise and streamline your inbound payments with our O2C solutions by efficiently processing your incoming orders, assessing customer risk, accurately deploying collection and dispute strategies and highly automating your cash application.

Central control and transparency over group-wide cash is essential for every organisation. Make your payment processes highly secure and compliant with international regulations utilising standardised and automated processes for your outbound payments including fraud prevention – at all times.

Increase operational savings, efficiencies, and compliance with our data and document management solutions. ECM360 helps you to better control access to information, reduce data volume, and comply with privacy and retention requirements from the moment data is received or created throughout the information lifecycle.

Expertise, Security and Visibility Delivered from One Single Source

Generating Added Value for Your Corporate Clients

Helping Organisations Achieve Cash Visibility and Secure Financial Processes

The financial solutions we offer support over 2,500 companies worldwide with advanced technology and personalised consulting to optimise all processes that manage incoming and outgoing payments. Our clients are able to achieve the highest possible process efficiency and transparency.

Pixel ignition Ltd (2003) T/A ECM360 leverages industry leading easily configurable technology platforms to solve business challenges that prevent organisations from meeting their ever-changing business needs. We do this through the creation, storage, collaboration, protection and management of a wide range of digital content and information thereby optimising your business resources.

Level 8, 139 Quay Street

Auckland 1010

New Zealand

Telephone: +64 9 363 2768

E-mail: info@ecm360.co.nz